In her article, “Linking Debt and Income,” Inside Higher Ed, January 18, 2010, Jennifer Epstein reports that the U.S. Department of Education recently proposed that vocational and for-profit colleges meet minimum standards for debt-to-income ratios for recent graduates. The average debt repayment could be no more than eight percent (8%) of expected earnings in the field. The presumptive expected earnings would be the 25th percentile of incomes in the field for which they had been trained.

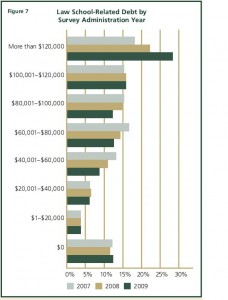

How would that work for law schools? Going to law school is expensive, and often financed with debt. The 2009 Survey Results of the Law School Survey of Student Engagement tells us that 29% of the students surveyed expected to graduate with law-school related debt of at least $120,000. The following chart from page 14 of the 2009 Annual Survey of law students shows the law-school debt levels expected by current law students.

According to the May 2008 Occupational Employment and Wage Estimates of the Bureau of Labor Statistics (National Cross-Industry Estimates [.zip file]) the 25th percentile of annual income for lawyers was just under $75,000. That would make the maximum annual payment just under $6,000. Assuming a modest ten percent (10%) interest rate,* the maximum average school debt would be just over $45,000.

But over two-thirds of students surveyed in 2009 by LSSSE expect to graduate with law school debt of $60,000 or higher. According to Epstein, schools that don’t meet the eight percent (8%) of presumptive earnings could show

- actual-median earnings to average-debt ratios of 8% or below,

- a 75% loan repayment rate , or

- program completion and in-field placement rates of at least 70%.

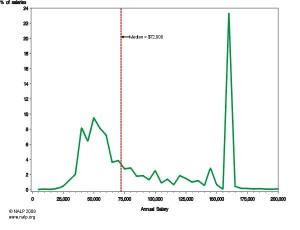

The following chart from the National Association of Law Placement shows the distribution of salaries of the Class of 2008:

Class of 2008, Distribution of Salaries (NALP)

The overall median of $72,000 is just under the May 2008 25th percentile of lawyer salaries ($75,000), so there is no wiggle room there.

Should law schools start reporting salary and debt-load information for its recent graduates?

posted by Gary Rosin

*Interest rates on guaranteed student loans in repayment are now about 2.5%. I’ll have to check on the current average for non-guarnateed loans. In event, current interest rates are abnormally low.

This entry was posted on Monday, January 18th, 2010 at 5:02 pm and is filed under Commentary, Law Schools. You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response, or trackback from your own site.

Law-School Debt Loads

In her article, “Linking Debt and Income,” Inside Higher Ed, January 18, 2010, Jennifer Epstein reports that the U.S. Department of Education recently proposed that vocational and for-profit colleges meet minimum standards for debt-to-income ratios for recent graduates. The average debt repayment could be no more than eight percent (8%) of expected earnings in the field. The presumptive expected earnings would be the 25th percentile of incomes in the field for which they had been trained.

How would that work for law schools? Going to law school is expensive, and often financed with debt. The 2009 Survey Results of the Law School Survey of Student Engagement tells us that 29% of the students surveyed expected to graduate with law-school related debt of at least $120,000. The following chart from page 14 of the 2009 Annual Survey of law students shows the law-school debt levels expected by current law students.

According to the May 2008 Occupational Employment and Wage Estimates of the Bureau of Labor Statistics (National Cross-Industry Estimates [.zip file]) the 25th percentile of annual income for lawyers was just under $75,000. That would make the maximum annual payment just under $6,000. Assuming a modest ten percent (10%) interest rate,* the maximum average school debt would be just over $45,000.

But over two-thirds of students surveyed in 2009 by LSSSE expect to graduate with law school debt of $60,000 or higher. According to Epstein, schools that don’t meet the eight percent (8%) of presumptive earnings could show

The following chart from the National Association of Law Placement shows the distribution of salaries of the Class of 2008:

Class of 2008, Distribution of Salaries (NALP)

The overall median of $72,000 is just under the May 2008 25th percentile of lawyer salaries ($75,000), so there is no wiggle room there.

Should law schools start reporting salary and debt-load information for its recent graduates?

posted by Gary Rosin

*Interest rates on guaranteed student loans in repayment are now about 2.5%. I’ll have to check on the current average for non-guarnateed loans. In event, current interest rates are abnormally low.

This entry was posted on Monday, January 18th, 2010 at 5:02 pm and is filed under Commentary, Law Schools. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.